12/25/2009

12/21/2009

on avatar

Seeing as how it takes about two days to watch Avatar, I figure it's worth offering a couple comments now that we've gone and seen it.

First, know whether you want to see it in 2D or 3D. We went on a Sunday and spent $12 on tickets. Nevermind what can be done with 3D, and with several movies in preview for their own 3D debut next year, it ain't ever being any more than a gimmick at that rate. Make it an event, because it'll cost you.

Second, remember this is a James Cameron movie. If you liked Terminator despite the 'dudes' and 'no problemos', you'll love Avatar. If you liked it because of the dialogue, you'll never leave the theater. And if you thought Titanic and Aliens were extravagantly boring wannabe documentaries with no plot, well, don't even go bothering to see Avatar.

You see, I can make some fairly specific statements about Avatar without giving anything away, because you already know the movie. The Terminator has his T1/T2 split while figuring out whether the Aliens are out to get him or should be protected. The backstory is straight out of Doom and Aliens: human trans-galactic corporation sends a department to extract important resource from foreign planet. Hostiles are present. Plot development involves various attempts to provide depth and complexity to hostiles. After surviving the first hour of the movie, the audience gets to watch the actual movie they came to see.

Here's the thing. And opinions in our little group were widespread on this, but I ate this movie up. It is awesome. It needs to be released on DVD in two versions: the edited down director's cut that's just a 90-100 minute movie, taking out the extraneously long unedited/un-proofed dialog/monologuey scenes, and another that is 10 hours long in the BBC-style documentary Planet Earth. Avatar: Planet Pandora could become the best selling faux-documentary Discovery Channel/History Channel collaboration of all time.

You see, depending on who you talked to, there was either too much cheesy dialogue or not enough time spent explaining everything, the movie was either too long or there wasn't enough plot, too many preachy soliloquies, or not enough effort spent making the emotion Cameron attaches to the characters organically earned rather than artificially forced.

And perhaps that's the coolest thing about Cameron pouring his heart into this. That is precisely what's wrong with actual military misadventures of America's recent (and not so recent) past. We're schizophrenic. We can't decide if we've been at it way too long, or if the Long War is just getting started.

For both the movie and real-life, there's plenty of ground left for both prequels and sequels.

First, know whether you want to see it in 2D or 3D. We went on a Sunday and spent $12 on tickets. Nevermind what can be done with 3D, and with several movies in preview for their own 3D debut next year, it ain't ever being any more than a gimmick at that rate. Make it an event, because it'll cost you.

Second, remember this is a James Cameron movie. If you liked Terminator despite the 'dudes' and 'no problemos', you'll love Avatar. If you liked it because of the dialogue, you'll never leave the theater. And if you thought Titanic and Aliens were extravagantly boring wannabe documentaries with no plot, well, don't even go bothering to see Avatar.

You see, I can make some fairly specific statements about Avatar without giving anything away, because you already know the movie. The Terminator has his T1/T2 split while figuring out whether the Aliens are out to get him or should be protected. The backstory is straight out of Doom and Aliens: human trans-galactic corporation sends a department to extract important resource from foreign planet. Hostiles are present. Plot development involves various attempts to provide depth and complexity to hostiles. After surviving the first hour of the movie, the audience gets to watch the actual movie they came to see.

Here's the thing. And opinions in our little group were widespread on this, but I ate this movie up. It is awesome. It needs to be released on DVD in two versions: the edited down director's cut that's just a 90-100 minute movie, taking out the extraneously long unedited/un-proofed dialog/monologuey scenes, and another that is 10 hours long in the BBC-style documentary Planet Earth. Avatar: Planet Pandora could become the best selling faux-documentary Discovery Channel/History Channel collaboration of all time.

You see, depending on who you talked to, there was either too much cheesy dialogue or not enough time spent explaining everything, the movie was either too long or there wasn't enough plot, too many preachy soliloquies, or not enough effort spent making the emotion Cameron attaches to the characters organically earned rather than artificially forced.

And perhaps that's the coolest thing about Cameron pouring his heart into this. That is precisely what's wrong with actual military misadventures of America's recent (and not so recent) past. We're schizophrenic. We can't decide if we've been at it way too long, or if the Long War is just getting started.

For both the movie and real-life, there's plenty of ground left for both prequels and sequels.

11/17/2009

it's official

Greinke wins the Cy Young Award. How about that. Could you imagine if he was pitching in front of an outfield of, say, Carlos Beltran, Jermaine Dye, and Raul Ibanez? Baseball is an odd sport. It has good draft and trading systems that allow all franchises to develop star athletes. It just doesn't have the revenue structure to allow any but the largest TV markets to keep a nucleus of players for very long.

11/15/2009

raider week pulls it out

It's been a long season, and we're barely more than half way through.

But the Chiefs sweatshirt was not for naught this evening! Time to go shopping for dinner now. Broccoli and Tacos.

And whatever unhealthy government subsidized sugar product captures our eye. I'm thinking glazed donut holes. But I get those a lot. Perhaps I'll branch out into ice cream sandwiches. That sounds good too.

But the Chiefs sweatshirt was not for naught this evening! Time to go shopping for dinner now. Broccoli and Tacos.

And whatever unhealthy government subsidized sugar product captures our eye. I'm thinking glazed donut holes. But I get those a lot. Perhaps I'll branch out into ice cream sandwiches. That sounds good too.

11/11/2009

happy armistice day

Well, we're about where we were last year. As we remember peace and veterans, we're stuck with wars and way too many policy areas that deny veterans the support they need.

How is it that there are homeless veterans in our country? Those without decent employment? Backlogs at the VA? Why does our prison system incarcerate so many veterans?

Don't hold your breath waiting for politicians to do anything bold about it. They're too busy waving their flags at the parades and talking about how brave and heroic other people are to allocate any real public dollars to these problems.

After all, we need the money to bail out corporate criminals and pay private mercenaries to imprison, torture, and kill scary muslim foreigners.

How is it that there are homeless veterans in our country? Those without decent employment? Backlogs at the VA? Why does our prison system incarcerate so many veterans?

Don't hold your breath waiting for politicians to do anything bold about it. They're too busy waving their flags at the parades and talking about how brave and heroic other people are to allocate any real public dollars to these problems.

After all, we need the money to bail out corporate criminals and pay private mercenaries to imprison, torture, and kill scary muslim foreigners.

11/10/2009

reproductive (non)healthcare

(P) This isn't about whether you should get an abortion or not. That's a touchy, complicated, messy personal question.

This is about how Democrats are stupid. That's something we can probably all agree on.

When you look at demographics, who votes for Democrats? Well, it ain't richer pro-life men. It's less affluent pro-choice women.

And can you think of anything stupider than telling your base that a common medical procedure isn't part of the healthcare debate? That's pretty much what the Stupak-Pitts amendment does, singling out funding to abortion services in health insurance plans (nevermind that the 1970s-era Hyde Amendment already prevents federal funding from being used for abortion services). Rules on excluding Viagra and Cialis apparently didn't pass the profit test.

'Reproductive justice', 'women's health', 'a woman's fundamental right to choose', 'affordable health care': these are core slogans that get Democrats elected.

This is like if the GOP came into office and decided to increase taxes on the wealthy. That'd get them real far with their base.

Just a refresher, this was Obama on the campaign trail:

And on ABC this week:

The comedy really just writes itself. God bless Rahm Emanuel. He probably thinks this is what constitutes 11 dimensional chess. And it's a good thing Pelosi kept impeachment off the table so there was room for this political masterstroke of genius.

This is about how Democrats are stupid. That's something we can probably all agree on.

When you look at demographics, who votes for Democrats? Well, it ain't richer pro-life men. It's less affluent pro-choice women.

And can you think of anything stupider than telling your base that a common medical procedure isn't part of the healthcare debate? That's pretty much what the Stupak-Pitts amendment does, singling out funding to abortion services in health insurance plans (nevermind that the 1970s-era Hyde Amendment already prevents federal funding from being used for abortion services). Rules on excluding Viagra and Cialis apparently didn't pass the profit test.

'Reproductive justice', 'women's health', 'a woman's fundamental right to choose', 'affordable health care': these are core slogans that get Democrats elected.

This is like if the GOP came into office and decided to increase taxes on the wealthy. That'd get them real far with their base.

Just a refresher, this was Obama on the campaign trail:

Chicago, IL | January 22, 2008

Chicago, IL -- Senator Barack Obama today released the following statement on the 35th anniversary of the Roe v. Wade decision.

"Thirty-five years after the Supreme Court decided Roe v. Wade, it's never been more important to protect a woman's right to choose. Last year, the Supreme Court decided by a vote of 5-4 to uphold the Federal Abortion Ban, and in doing so undermined an important principle of Roe v. Wade: that we must always protect women's health. With one more vacancy on the Supreme Court, we could be looking at a majority hostile to a women's fundamental right to choose for the first time since Roe v. Wade. The next president may be asked to nominate that Supreme Court justice. That is what is at stake in this election.

"Throughout my career, I've been a consistent and strong supporter of reproductive justice, and have consistently had a 100% pro-choice rating with Planned Parenthood and NARAL Pro-Choice America.

"When South Dakota passed a law banning all abortions in a direct effort to have Roe overruled, I was the only candidate for President to raise money to help the citizens of South Dakota repeal that law. When anti-choice protesters blocked the opening of an Illinois Planned Parenthood clinic in a community where affordable health care is in short supply, I was the only candidate for President who spoke out against it. And I will continue to defend this right by passing the Freedom of Choice Act as president.

And on ABC this week:

"I laid out a very simple principle, which is this is a health care bill, not an abortion bill," Obama said. "And we're not looking to change what is the principle that has been in place for a very long time, which is federal dollars are not used to subsidize abortions."

Saying the bill cannot change the status quo regarding the ban on federally funded abortions, the president said, "There are strong feelings on both sides" about an amendment passed Saturday and added to the legislation, "and what that tells me is that there needs to be some more work before we get to the point where we're not changing the status quo."

The comedy really just writes itself. God bless Rahm Emanuel. He probably thinks this is what constitutes 11 dimensional chess. And it's a good thing Pelosi kept impeachment off the table so there was room for this political masterstroke of genius.

10/29/2009

oppressors get upset, hilarity ensues

Let me premise this by saying I'm not one of those people who thinks we live in an honest, full blown police state, but I do care a lot about Constitutional rights (I did grow up in a town called Liberty, after all) and probably follow related news more than the average bear.

Well, sometimes our surveillance society ends up being comical as much as anything else. Check out these two stories I saw together this evening.

First, the Pittsburgh G-20 Twitter-Terrorist (I have that copyrighted, CNN!) appears to actually be under real government investigation. It wasn't enough that the police spent 16 hours searching his home for...something (the warrant wasn't real clear on that). A federal Grand Jury indicted him on a separate line of inquiry about alleged violations of the Anti-Riot Act. Yes, the guy tweeting publicly available locations of police who shouldn't even have been deployed so that protestors could avoid them is accused of inciting a riot. That's just brilliant. Next thing you know, people who advocate nonviolence are going to be locked up in jail as dangerous criminals. Oh wait, we have a great history of doing that, from this guy to that one.

The second thing I ran across was this devious sex criminal. How do I know she's devious? She's a Philadelphia Phillies fan, of course. She posted an ad on Craigslist. The Philly police, naturally having nothing else to do, read through Craigslist, found her ad, and asked her to meet a guy in a bar. They talked for awhile until some sort of implied offer for World Series tickets involved, gasp, sex. Then presto, guy replying to ad about World Series tickets turns out to be a cop, girl wanting World Series tickets turns out to be a danger to society.

Thank you Pennsylvania for removing two hardened, dangerous, violent criminals off our streets!

Well, sometimes our surveillance society ends up being comical as much as anything else. Check out these two stories I saw together this evening.

First, the Pittsburgh G-20 Twitter-Terrorist (I have that copyrighted, CNN!) appears to actually be under real government investigation. It wasn't enough that the police spent 16 hours searching his home for...something (the warrant wasn't real clear on that). A federal Grand Jury indicted him on a separate line of inquiry about alleged violations of the Anti-Riot Act. Yes, the guy tweeting publicly available locations of police who shouldn't even have been deployed so that protestors could avoid them is accused of inciting a riot. That's just brilliant. Next thing you know, people who advocate nonviolence are going to be locked up in jail as dangerous criminals. Oh wait, we have a great history of doing that, from this guy to that one.

The second thing I ran across was this devious sex criminal. How do I know she's devious? She's a Philadelphia Phillies fan, of course. She posted an ad on Craigslist. The Philly police, naturally having nothing else to do, read through Craigslist, found her ad, and asked her to meet a guy in a bar. They talked for awhile until some sort of implied offer for World Series tickets involved, gasp, sex. Then presto, guy replying to ad about World Series tickets turns out to be a cop, girl wanting World Series tickets turns out to be a danger to society.

Thank you Pennsylvania for removing two hardened, dangerous, violent criminals off our streets!

10/20/2009

this is inappropriate

and way behind the times because it's a rerun but must be shared widely anyway.

Colbert's MILF comment about Dow 10,000 was absolute classic comedy.

Now that's a Market I'd Like to see Fluctuate.

Colbert's MILF comment about Dow 10,000 was absolute classic comedy.

Now that's a Market I'd Like to see Fluctuate.

9/22/2009

toys

Excitement on the home front. New toys have come in. Now it's off to move things around, install some software, test everything, and hand things out. The laptop is going to my sister, and the desktop is off on loan to Julie. I think they must have expedited the shipping, because there was a problem with the credit card yesterday. Apparently buying stuff from all over the country set off Discover Card's fraud detection system and both Discover and MacMall called me. So I was a little surprised when my ground shipping that just went out yesterday afternoon was in my condo today when I got home from work!

P.S. To all our Fearless Leaders and Powers that Be: I am doing everything humanly possible to stimulate the economy. My roommate and I moved into a new condo. My little car has requested multiple expensive repairs. And now there is much shuffling of electronics to get to various peoples.

Now, please do your part! We need healthcare reform that eliminates the inefficiencies of the health insurance industry and ends the job bondage of employer-based healthcare. We need unemployment insurance that actually covers people who are unemployed, not just people laid off under certain limited circumstances. We need financial companies taken over, management fired, insolvent companies put through bankruptcy, decades-old regulations re-instituted, and new regulations implemented. We need, in short, policy aimed to benefit all Americans, not just a few.

/rant

Okay, optimistic Nate back. Yay toys!

P.S. To all our Fearless Leaders and Powers that Be: I am doing everything humanly possible to stimulate the economy. My roommate and I moved into a new condo. My little car has requested multiple expensive repairs. And now there is much shuffling of electronics to get to various peoples.

Now, please do your part! We need healthcare reform that eliminates the inefficiencies of the health insurance industry and ends the job bondage of employer-based healthcare. We need unemployment insurance that actually covers people who are unemployed, not just people laid off under certain limited circumstances. We need financial companies taken over, management fired, insolvent companies put through bankruptcy, decades-old regulations re-instituted, and new regulations implemented. We need, in short, policy aimed to benefit all Americans, not just a few.

/rant

Okay, optimistic Nate back. Yay toys!

8/30/2009

finance jokes

8/28/2009

the disgustingness continues

(P) This week, the ACLU put up another document that the government has belatedly released regarding the criminal (er, heroic, terrorist-stopping, manly, beer-drinking) acts of the senior officials of the Bush Administration.

As the document bureaucratically explains:

What I think is going to surprise a lot of people as more and more of the details trickle out is how cold and calculated everything is. One of the features of a large organization is that bureaucracy involves lots of decision-makers, and in order to disseminate information among the various groups, there is lots of information sent back and forth. The nature of this process thus can almost hilariously contrast with the particular subject matter at hand. Our nation's leaders discussed war crimes, treaty violations, and felonies as if they were discussing where to build a new highway interchange or quarterly projections for GDP growth.

This process is precisely why transparency, openness, 'sunshine', is a core element of good governance. Decision-makers have to know at the time of their decisions that their deliberations will become public, that there will be social and legal consequences for blatantly improper courses of action.

The PDF for this document from 2004 sent to the Office of Legal Counsel from the Central Intelligence Agency can be downloaded here. It's been clear for awhile that this is no group of 'bad apples' or 'rogue agents' or other nonsense. The dedicated staff at the CIA, NSA, DIA, INR, etc, etc, who are monitoring my blog, your email, your mom's phone conversations, your dad's credit history, your neighbor's political contributions, your kid's internet postings, your grandma's participation in peace groups, etc, etc, are not the people who designed these policies. And to a great extent, it's the bureaucracy itself, the countless professional civil servants, who are able to apply the brakes internally, to slow down inappropriate, counterproductive, illegal programs.

But that only stops so much. When a group of our leaders is committed to ignoring the law, there is only one group of people that can stand up to them, and that is us, We the People. Seven years after we first started this particular bit of horrific, counterproductive, illicit behavior, we have yet to stop it completely, let alone hold the architects accountable for their creation.

But hey, at least we've been able to arrest millions of other Americans over the past seven years for grave allegations like shoplifting, prostitution, and marijuana possession. It's good we've got our 'tough on crime' priorities in order.

As the document bureaucratically explains:

Note: This paper provides further background information and details on High Value Detainee (HVD) interrogation techniques to support documents CIA has previously provided the Department of Justice.

This paper focuses strictly on the topic of combined uses of interrogation techniques.

What I think is going to surprise a lot of people as more and more of the details trickle out is how cold and calculated everything is. One of the features of a large organization is that bureaucracy involves lots of decision-makers, and in order to disseminate information among the various groups, there is lots of information sent back and forth. The nature of this process thus can almost hilariously contrast with the particular subject matter at hand. Our nation's leaders discussed war crimes, treaty violations, and felonies as if they were discussing where to build a new highway interchange or quarterly projections for GDP growth.

This process is precisely why transparency, openness, 'sunshine', is a core element of good governance. Decision-makers have to know at the time of their decisions that their deliberations will become public, that there will be social and legal consequences for blatantly improper courses of action.

The PDF for this document from 2004 sent to the Office of Legal Counsel from the Central Intelligence Agency can be downloaded here. It's been clear for awhile that this is no group of 'bad apples' or 'rogue agents' or other nonsense. The dedicated staff at the CIA, NSA, DIA, INR, etc, etc, who are monitoring my blog, your email, your mom's phone conversations, your dad's credit history, your neighbor's political contributions, your kid's internet postings, your grandma's participation in peace groups, etc, etc, are not the people who designed these policies. And to a great extent, it's the bureaucracy itself, the countless professional civil servants, who are able to apply the brakes internally, to slow down inappropriate, counterproductive, illegal programs.

But that only stops so much. When a group of our leaders is committed to ignoring the law, there is only one group of people that can stand up to them, and that is us, We the People. Seven years after we first started this particular bit of horrific, counterproductive, illicit behavior, we have yet to stop it completely, let alone hold the architects accountable for their creation.

But hey, at least we've been able to arrest millions of other Americans over the past seven years for grave allegations like shoplifting, prostitution, and marijuana possession. It's good we've got our 'tough on crime' priorities in order.

8/23/2009

how did i miss this

Oh, I can't believe I didn't see this clip before. This is John McCain back in Iowa on whether he's ever not had government healthcare.

Check it out!

Check it out!

8/16/2009

a tale of two brits

(P) I found these two articles from British outlets deliciously contrasting in their presentation of the healthcare debate in America.

First, from the Economist, we have "Friend or Foe? It is not wise for Democrats to bash America's health insurers".

Then, from the Independent UK, we have "The brutal truth about America’s healthcare: An extraordinary report from Guy Adams in Los Angeles at the music arena that has been turned into a makeshift medical centre".

Can you guess from the title which one is the concern troll about bashing health insurance companies, and which one is the detailed reporting about the lack of access to quality medical care in the United States?

Let's play a little game. Guess which article the quotes come from.

1. "For one thing, the punters at these meetings often have poignant and unscripted personal tales that explain their distrust of proposed reforms. Also, numerous polls now confirm that scepticism among Americans at large—and independents in particular—is growing about health reform."

2. "They came in their thousands, queuing through the night to secure one of the coveted wristbands offering entry into a strange parallel universe where medical care is a free and basic right and not an expensive luxury. Some of these Americans had walked miles simply to have their blood pressure checked, some had slept in their cars in the hope of getting an eye-test or a mammogram, others had brought their children for immunizations that could end up saving their life."

3. "The more underhanded gambit is the decision to bash the insurance industry at every turn. Ms Pelosi now calls its bosses “villains”, while Mr Obama wags a disapproving finger. This will score some political points, as many Americans have a deep (and often well-founded) distrust of health insurers. But the tactic could ultimately hobble or even doom reform."

4. "Although the Americans spend more on medicine than any nation on earth, there are an estimated 50 million with no health insurance at all. Many of those who have jobs can't afford coverage, and even those with standard policies often find it doesn't cover commonplace procedures. California's unemployed - who rely on Medicaid - had their dental care axed last month."

5. "Though it has a shameful history, the insurance industry has done a U-turn of late. It now accepts the need for a radical overhaul of insurance markets through measures such as guaranteed issue of coverage and the creation of health insurance “exchanges”. But its leaders are increasingly unhappy about the shrill attacks. Can Mr Obama continue to bash the insurers one day and rely on them the next?"

6. "I've been very conservative in my outlook for the whole of my life. I've been described as being about 90,000 miles to the right of Attila the Hun. But I think one reaches the reality that something doesn't work... In this country something has to be done. And as a proud member of the US community but a loyal British subject to the core, I would say that if Britain could fix it in 1944, surely we could fix it here in America."

Hint: this test is designed to be easy. It goes E/I/E/I/E/I. Oh, but you probably figured that out already.

First, from the Economist, we have "Friend or Foe? It is not wise for Democrats to bash America's health insurers".

Then, from the Independent UK, we have "The brutal truth about America’s healthcare: An extraordinary report from Guy Adams in Los Angeles at the music arena that has been turned into a makeshift medical centre".

Can you guess from the title which one is the concern troll about bashing health insurance companies, and which one is the detailed reporting about the lack of access to quality medical care in the United States?

Let's play a little game. Guess which article the quotes come from.

1. "For one thing, the punters at these meetings often have poignant and unscripted personal tales that explain their distrust of proposed reforms. Also, numerous polls now confirm that scepticism among Americans at large—and independents in particular—is growing about health reform."

2. "They came in their thousands, queuing through the night to secure one of the coveted wristbands offering entry into a strange parallel universe where medical care is a free and basic right and not an expensive luxury. Some of these Americans had walked miles simply to have their blood pressure checked, some had slept in their cars in the hope of getting an eye-test or a mammogram, others had brought their children for immunizations that could end up saving their life."

3. "The more underhanded gambit is the decision to bash the insurance industry at every turn. Ms Pelosi now calls its bosses “villains”, while Mr Obama wags a disapproving finger. This will score some political points, as many Americans have a deep (and often well-founded) distrust of health insurers. But the tactic could ultimately hobble or even doom reform."

4. "Although the Americans spend more on medicine than any nation on earth, there are an estimated 50 million with no health insurance at all. Many of those who have jobs can't afford coverage, and even those with standard policies often find it doesn't cover commonplace procedures. California's unemployed - who rely on Medicaid - had their dental care axed last month."

5. "Though it has a shameful history, the insurance industry has done a U-turn of late. It now accepts the need for a radical overhaul of insurance markets through measures such as guaranteed issue of coverage and the creation of health insurance “exchanges”. But its leaders are increasingly unhappy about the shrill attacks. Can Mr Obama continue to bash the insurers one day and rely on them the next?"

6. "I've been very conservative in my outlook for the whole of my life. I've been described as being about 90,000 miles to the right of Attila the Hun. But I think one reaches the reality that something doesn't work... In this country something has to be done. And as a proud member of the US community but a loyal British subject to the core, I would say that if Britain could fix it in 1944, surely we could fix it here in America."

Hint: this test is designed to be easy. It goes E/I/E/I/E/I. Oh, but you probably figured that out already.

8/04/2009

unsanitizing torture

(P) I personally tend to be more discrete and diplomatic in my communication, but I wanted to highlight somebody being a little more direct in telling it like it is. The notion that our prison policies have been anything but immoral, illegal, and counterproductive is pretty funny.

Some articles have a way of just lettin' it all hang out, leaving little to the imagination. The graphic alone makes reading this story worth it.

I would normally give a warning that this is mature content, but this is what our government is doing in our name to real human beings. How can conduct be so horrific we should shelter our kids from it, but at the same time, not be worth investigating and prosecuting? That's a rhetorical question, of course. Of the millions of Americans who have been arrested in the last few years, few have committed crimes even remotely as disgusting or an as large a scale as the senior officials of the Bush Administration.

For your reading pleasure, Whores on Terror by Allan Uthman.

A snippet:

Some articles have a way of just lettin' it all hang out, leaving little to the imagination. The graphic alone makes reading this story worth it.

I would normally give a warning that this is mature content, but this is what our government is doing in our name to real human beings. How can conduct be so horrific we should shelter our kids from it, but at the same time, not be worth investigating and prosecuting? That's a rhetorical question, of course. Of the millions of Americans who have been arrested in the last few years, few have committed crimes even remotely as disgusting or an as large a scale as the senior officials of the Bush Administration.

For your reading pleasure, Whores on Terror by Allan Uthman.

A snippet:

I don’t want to come off as minimizing the horror of controlled drowning. It’s just that there’s something about forcible anal rape that brings the torture issue into sharp focus. Just once, I’d like to hear one of these American Enterprise Institute psychos, the ones that always trot out to defend the Neocons’ freakish obsessions, have to defend shoving a flashlight up a guy’s ass. I want to hear Frank Gaffney or Jonah Goldberg tell me why I shouldn’t be fucking mortified that raping prisoners was considered within tolerable interrogation practices by my country. I want Glenn Beck to justify butt-raping a suspect.

Labels:

afghanistan,

bush,

crime,

gwot,

intelligence,

iraq,

torture

7/26/2009

pop quiz for the day

(R) So, you just walked into Finance 101 and the professor hands you a quiz.

Don't worry, it's not a bad dream! It's multiple choice, so you've got good odds. Much better odds than the ratings agencies seem to have of rating things.

The assertion that pricing for various financial products (stocks, commodities, derivatives, etc) is normally distributed (ie, bell curve, Gaussian, etc) is best described as

a. True

b. False

If you chose B, you're correct! (Note, if you wrote in choice c. So wrecklessly false that the regulators should be fired and the corporate executives prosecuted for threatening our national security, that answer would also be acceptable. Please be aware the NSA has been notified of your opinion, so they can forward that to Goldman Sachs, who is requesting that the FBI begin an investigation of you.)

I've been doing a little reading of book reviews to add some items to my Amazon wish list (hint, it's right here), and I have enjoyed the commentary mocking our esteemed Masters of the Universe (no, not this).

I've never excelled at the probability and statistics arena. Perhaps that's part of what makes it so juicily delicious that the guys who thought they did understand screwed up so royally. Being part of a tail, an outlier, one develops an appreciation for other outliers. The way I figure it, if you can recognize when the professor puts up the data points for the test that you're an outlier and calculate that your score was in the bottom 5% because you were over two standard deviations from the mean, that should mean you understand the material. But alas, I digress.

The point of this diatribe isn't to look back fondly upon those lovely two semesters of stats ('Quantitative Business Analysis' in the Olin lingo du jour). Rather, the point is to serve as a reminder that common sense is a bedrock principle for designing policies in the real world. The mathematics itself is rarely flawed. Unfortunately, real people have a tendency to apply math in ways where the real world doesn't match the academic assumptions. When this is done accidentally, it's sad enough.

When this is coordinated policy at some of the most powerful corporations in the country, it's infuriating. And dangerous, a threat to our welfare and even our democracy.

Perhaps the most skewered comment by an executive back in 2007 when all this was unfolding was offered by David Viniar, Goldman Sachs' Chief Financial Officer. See if you can spot the crazy.

He followed that with, oh, and the Kansas City Royals are going to win the next 5 World Series.

For the book review from Naked Capitalism on Lecturing Birds on Flying, click here. For some handy concise definitions and charts, Risk Glossary is very nice. For regulators/executives/both I'm not too fond of, see Hank 'the banks are sound' Paulson, Gary 'don't regulate derivatives' Gensler, Ed 'AIG bonus contracts are sacred' Liddy, or Lloyd 'we're fully hedged but put me in the meeting anyway' Blankfein.

And those are just the recent Goldman visionaries.

Don't even get me started on Robert 'see, Dems can represent corporate America, too' Rubin, Larry 'don't ask who paid me money when it looked like I was going to be close to the new President' Summers, Tim 'I couldn't possibly be responsible for anything, all I did was run the NY Fed' Geithner, or Ben 'at least I'm not Alan' Bernanke.

/(R) That does feel a lot better.

Now if we could just please have our trillions of tax dollars back please.

Don't worry, it's not a bad dream! It's multiple choice, so you've got good odds. Much better odds than the ratings agencies seem to have of rating things.

The assertion that pricing for various financial products (stocks, commodities, derivatives, etc) is normally distributed (ie, bell curve, Gaussian, etc) is best described as

a. True

b. False

If you chose B, you're correct! (Note, if you wrote in choice c. So wrecklessly false that the regulators should be fired and the corporate executives prosecuted for threatening our national security, that answer would also be acceptable. Please be aware the NSA has been notified of your opinion, so they can forward that to Goldman Sachs, who is requesting that the FBI begin an investigation of you.)

I've been doing a little reading of book reviews to add some items to my Amazon wish list (hint, it's right here), and I have enjoyed the commentary mocking our esteemed Masters of the Universe (no, not this).

I've never excelled at the probability and statistics arena. Perhaps that's part of what makes it so juicily delicious that the guys who thought they did understand screwed up so royally. Being part of a tail, an outlier, one develops an appreciation for other outliers. The way I figure it, if you can recognize when the professor puts up the data points for the test that you're an outlier and calculate that your score was in the bottom 5% because you were over two standard deviations from the mean, that should mean you understand the material. But alas, I digress.

The point of this diatribe isn't to look back fondly upon those lovely two semesters of stats ('Quantitative Business Analysis' in the Olin lingo du jour). Rather, the point is to serve as a reminder that common sense is a bedrock principle for designing policies in the real world. The mathematics itself is rarely flawed. Unfortunately, real people have a tendency to apply math in ways where the real world doesn't match the academic assumptions. When this is done accidentally, it's sad enough.

When this is coordinated policy at some of the most powerful corporations in the country, it's infuriating. And dangerous, a threat to our welfare and even our democracy.

Perhaps the most skewered comment by an executive back in 2007 when all this was unfolding was offered by David Viniar, Goldman Sachs' Chief Financial Officer. See if you can spot the crazy.

“We were seeing things that were 25-standard deviation moves, several days in a row,” said David Viniar, Goldman’s chief financial officer.

He followed that with, oh, and the Kansas City Royals are going to win the next 5 World Series.

For the book review from Naked Capitalism on Lecturing Birds on Flying, click here. For some handy concise definitions and charts, Risk Glossary is very nice. For regulators/executives/both I'm not too fond of, see Hank 'the banks are sound' Paulson, Gary 'don't regulate derivatives' Gensler, Ed 'AIG bonus contracts are sacred' Liddy, or Lloyd 'we're fully hedged but put me in the meeting anyway' Blankfein.

And those are just the recent Goldman visionaries.

Don't even get me started on Robert 'see, Dems can represent corporate America, too' Rubin, Larry 'don't ask who paid me money when it looked like I was going to be close to the new President' Summers, Tim 'I couldn't possibly be responsible for anything, all I did was run the NY Fed' Geithner, or Ben 'at least I'm not Alan' Bernanke.

/(R) That does feel a lot better.

Now if we could just please have our trillions of tax dollars back please.

7/22/2009

7/19/2009

i heart matt taibbi

There's a writer/journalist/all-around-troublemaker who has been particularly focused and intense recently that I think is very worthwhile reading if you are not familiar with him.

Matt Taibbi's blog can be found at True/Slant, and he has had some large pieces in outlets like Rolling Stone.

I wanted to point him out because he's been hitting a nerve that's a lot of why I went to business school. There has been such a void of real leadership in the business community that a lot of anger and outrage and disgust has been generated in society. Pew did a study recently that asked people to rank various professions that contribute to the well-being of society. The category for 'business executives' saw only 21% agree with an assessment of contributing a lot. Even lawyers were more widely regarded as contributors.

We're more and more confronting a crossroads, a major fork, of the whole concept of economics as it works in the United States. If you agree with Taibbi's general thrust, his reading is some of the most fun and in-depth you'll find anywhere. If you don't agree, I would argue, his stuff is that much more important to be aware of, because he's one of the writers that takes the time to spell out in detail his positions without losing the bluntness and passion that many people feel without being able to articulate quite so clearly.

If those of us who want to largely save a capitalist, market-based system don't deal with the factors that cause such disgust with the whole system, then ultimately we are going to face a much larger period of transition and dislocation. The longer we deny that excessive feeding of ego and greed cause systemic problems, the less credibility we have in offering tweaks to the system in the face of calls to overhaul the whole thing in favor of something much different.

Matt Taibbi's blog can be found at True/Slant, and he has had some large pieces in outlets like Rolling Stone.

I wanted to point him out because he's been hitting a nerve that's a lot of why I went to business school. There has been such a void of real leadership in the business community that a lot of anger and outrage and disgust has been generated in society. Pew did a study recently that asked people to rank various professions that contribute to the well-being of society. The category for 'business executives' saw only 21% agree with an assessment of contributing a lot. Even lawyers were more widely regarded as contributors.

We're more and more confronting a crossroads, a major fork, of the whole concept of economics as it works in the United States. If you agree with Taibbi's general thrust, his reading is some of the most fun and in-depth you'll find anywhere. If you don't agree, I would argue, his stuff is that much more important to be aware of, because he's one of the writers that takes the time to spell out in detail his positions without losing the bluntness and passion that many people feel without being able to articulate quite so clearly.

If those of us who want to largely save a capitalist, market-based system don't deal with the factors that cause such disgust with the whole system, then ultimately we are going to face a much larger period of transition and dislocation. The longer we deny that excessive feeding of ego and greed cause systemic problems, the less credibility we have in offering tweaks to the system in the face of calls to overhaul the whole thing in favor of something much different.

7/04/2009

happy independence day

A patriot is somebody who says what needs to be said, does what needs to be done, even if it means personal risk and sacrifice.

Fortunately, we have many American patriots showing us how to do it today.

Fortunately, we have many American patriots showing us how to do it today.

6/08/2009

goodbye apartment

Thanks to everyone who came by this weekend. It was a wonderful sendoff for the apartment and a great start to the summer!

5/29/2009

not cool enough for the central west end

But I'm moving there anyway. Ha.

This will be interesting. And you can see the cathedral basilica from my window.

Moving help appreciated on Saturday, June 13th :)

This will be interesting. And you can see the cathedral basilica from my window.

Moving help appreciated on Saturday, June 13th :)

5/06/2009

is this really happening

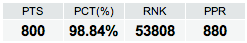

A month into the season, can the stats really look like this?

All five AL Central teams in the top half of baseball? Two in the top five? And what's that? Is that the Royals leading the division, garnering spot #3?

This must be a misprint, a mistake, a misunderstanding. At least, it's May.

And that's kind of exciting. Maybe, just maybe, they can keep this up.

4/12/2009

ten commandments for an economic resurrection

(P) A couple weeks ago, I wrote a detailed post emphasizing that we have options in restoring our financial system and our broader economy. We don't have to panic or accept bailouts of the very corporations that are responsible for our mess.

This morning, I'm posting a concise version that boils it down to the solutions. If you are interested in a more thorough discussion, here are the thoughts behind this.

There’s a lot of concern about the current status of our economy. It leads to natural questions like

What, exactly, should we do about it?

Don’t we have to bail out these companies?

What alternatives do we really have?

These steps can be taken immediately to address our present situation:

1. Take over failed firms that are 'too big to fail'.

2. Break up non-failed firms that are 'too big to fail'.

3. Provide direct assistance to stimulate the economy.

4. Make the jump from a minimum wage to a living wage.

5. Use our public policy to save communities, not companies.

After these initial coping mechanisms, we can start addressing some of the broader challenges we face:

6. Re-connect wages and productivity.

7. Re-regulate industries like financial services.

8. Re-invest in our public commons.

9. Re-write our tax code.

10. Re-think our social and military policies.

Call your Senators and Representative to see what they think about bailing out people instead of companies.

This morning, I'm posting a concise version that boils it down to the solutions. If you are interested in a more thorough discussion, here are the thoughts behind this.

Ten Commandments

for an

Economic Resurrection

"Human destiny will be what we make of it."

-- President Barack Obama in Prague

There’s a lot of concern about the current status of our economy. It leads to natural questions like

What, exactly, should we do about it?

Don’t we have to bail out these companies?

What alternatives do we really have?

These steps can be taken immediately to address our present situation:

1. Take over failed firms that are 'too big to fail'.

2. Break up non-failed firms that are 'too big to fail'.

3. Provide direct assistance to stimulate the economy.

4. Make the jump from a minimum wage to a living wage.

5. Use our public policy to save communities, not companies.

After these initial coping mechanisms, we can start addressing some of the broader challenges we face:

6. Re-connect wages and productivity.

7. Re-regulate industries like financial services.

8. Re-invest in our public commons.

9. Re-write our tax code.

10. Re-think our social and military policies.

Call your Senators and Representative to see what they think about bailing out people instead of companies.

4/10/2009

i want my money back

(P, R) Well, my checks to the Department of the Treasury and the Missouri Department of Revenue cleared the bank yesterday. I'm passionate year round about responsible uses of public dollars, but tax time does serve as a nice reminder as it puts the specific numbers in front of you in a way that can't be ignored.

For fun, I thought I'd break out rough estimates of spending categories exceeding $1,000 in 2008. I realize not everybody gets worked up by numbers, but these kinds of things really make me mad.

What's my top expense? Rent? Car insurance? Utilities? My Roth IRA? Nope. Federal income taxes.

1. Federal income taxes: $5,600

2. Roth IRA: $5,000

3. Rent: $4,900

4. Europe/Other travel: $4,000

5. Payroll taxes: $3,500

6. Groceries/Eating out: $2,500

7. Missouri income taxes: $1,800

8. Other taxes: $1,600

9. Car insurance: $1,300

10. Utilities: $1,300

In case you're keeping score, my rough estimate of my total tax burden last year (income, property, sales, OASDI, and medicare) is approximately $12,500.

Now, what separates me from the conservatives like Grover Norquist is that I'm not opposed to taxation per se. I recognize that programs require resources, and the purpose of taxation is to raise revenue to pay for those programs. I happen to like courts and armies and fire departments and schools and roads and subways and sewers and parks and so forth. Indeed, most people understand that in order to have these popular services, we have to be taxed.

What's aggravating, what gets me ranting around tax time, is the unnecessary expenses, the waste, the programs that do nothing to invest in the safety and prosperity of our country. The Republican Party has taken an interesting strategic course, which is to talk about fiscal responsibility while doing the opposite. The enormous disconnect between rhetoric and reality from the GOP leadership has done much to put them in an amazingly restrictive demographic situation looking forward. And the Democratic Party has certainly shown progress. But what stands out is how little has changed since the Democrats took control of Congress over two years ago now. It's like celebrating cutting an alcoholic back from 10 drinks a day to 9. Well, that's great and all, but it's only progress if much more noticeable changes are around the corner.

From corporate subsidies to war profiteering to the costs of inaction on things like mass transit, energy, and healthcare, there is enormous waste and outright theft going on in our system. We devote massive resources to law enforcement efforts against petty criminals, and yet these master thieves walk around freely enjoying the spoils of their endeavors. Maybe it's one of those cases where being mugged personally makes it easier for you to get angry about the more impersonal kinds of muggings going on.

AIG has been mugging me every month since last September. The broader financial bailouts, from Goldman to Citi and on, will be mugging me for years to come. The Iraq war has been mugging me every month since 2003. The drug war mugs me a couple times a year. Farm subsidies, wealthy tax cheats, on and on, these are greater thefts than any petty criminal who steals a hundred bucks from your wallet. Over six million Americans are incarcerated or on probation or parole. We've done God knows awful things to 'high value' detainees all over the world. And yet the very people who have caused massive suffering and looting still walk around in charge of our government and the financial industry they wrecked.

And then that doesn't even cover the opportunity costs, the extra expenses we pay because we don't have good mass transit systems, passenger rail lines, freight rail lines, wind and solar energy, single payer health insurance, universal unemployment insurance, and all the other investments that actually make us better off.

It's probably unrealistic to ask the rich to play by the same rules as the rest of us. The Bernie Madoffs of the financial world will be the Lynndie Englands of the war crimes world, people who did bad stuff, but who can serve to be scapegoats for the larger perpetrators rather than compasses pointing to the larger perpetrators. But at least, stop taking my tax dollars. If you want me to bail out Goldman Sachs, sell me as an investor, not a taxpayer. If you want me to fund a trillion dollar defense industry, fund everything else that lavishly, too, from education to healthcare to employment services to affordable housing to energy to transportation to the environment to every other sector that produces a bigger return than another Reaper flying over Pakistan.

For fun, I thought I'd break out rough estimates of spending categories exceeding $1,000 in 2008. I realize not everybody gets worked up by numbers, but these kinds of things really make me mad.

What's my top expense? Rent? Car insurance? Utilities? My Roth IRA? Nope. Federal income taxes.

1. Federal income taxes: $5,600

2. Roth IRA: $5,000

3. Rent: $4,900

4. Europe/Other travel: $4,000

5. Payroll taxes: $3,500

6. Groceries/Eating out: $2,500

7. Missouri income taxes: $1,800

8. Other taxes: $1,600

9. Car insurance: $1,300

10. Utilities: $1,300

In case you're keeping score, my rough estimate of my total tax burden last year (income, property, sales, OASDI, and medicare) is approximately $12,500.

Now, what separates me from the conservatives like Grover Norquist is that I'm not opposed to taxation per se. I recognize that programs require resources, and the purpose of taxation is to raise revenue to pay for those programs. I happen to like courts and armies and fire departments and schools and roads and subways and sewers and parks and so forth. Indeed, most people understand that in order to have these popular services, we have to be taxed.

What's aggravating, what gets me ranting around tax time, is the unnecessary expenses, the waste, the programs that do nothing to invest in the safety and prosperity of our country. The Republican Party has taken an interesting strategic course, which is to talk about fiscal responsibility while doing the opposite. The enormous disconnect between rhetoric and reality from the GOP leadership has done much to put them in an amazingly restrictive demographic situation looking forward. And the Democratic Party has certainly shown progress. But what stands out is how little has changed since the Democrats took control of Congress over two years ago now. It's like celebrating cutting an alcoholic back from 10 drinks a day to 9. Well, that's great and all, but it's only progress if much more noticeable changes are around the corner.

From corporate subsidies to war profiteering to the costs of inaction on things like mass transit, energy, and healthcare, there is enormous waste and outright theft going on in our system. We devote massive resources to law enforcement efforts against petty criminals, and yet these master thieves walk around freely enjoying the spoils of their endeavors. Maybe it's one of those cases where being mugged personally makes it easier for you to get angry about the more impersonal kinds of muggings going on.

AIG has been mugging me every month since last September. The broader financial bailouts, from Goldman to Citi and on, will be mugging me for years to come. The Iraq war has been mugging me every month since 2003. The drug war mugs me a couple times a year. Farm subsidies, wealthy tax cheats, on and on, these are greater thefts than any petty criminal who steals a hundred bucks from your wallet. Over six million Americans are incarcerated or on probation or parole. We've done God knows awful things to 'high value' detainees all over the world. And yet the very people who have caused massive suffering and looting still walk around in charge of our government and the financial industry they wrecked.

And then that doesn't even cover the opportunity costs, the extra expenses we pay because we don't have good mass transit systems, passenger rail lines, freight rail lines, wind and solar energy, single payer health insurance, universal unemployment insurance, and all the other investments that actually make us better off.

It's probably unrealistic to ask the rich to play by the same rules as the rest of us. The Bernie Madoffs of the financial world will be the Lynndie Englands of the war crimes world, people who did bad stuff, but who can serve to be scapegoats for the larger perpetrators rather than compasses pointing to the larger perpetrators. But at least, stop taking my tax dollars. If you want me to bail out Goldman Sachs, sell me as an investor, not a taxpayer. If you want me to fund a trillion dollar defense industry, fund everything else that lavishly, too, from education to healthcare to employment services to affordable housing to energy to transportation to the environment to every other sector that produces a bigger return than another Reaper flying over Pakistan.

Labels:

drug war,

gwot,

inequality,

iraq,

robbery,

rule of law,

taxes

4/07/2009

congratulations mayor slay

(P) I know the polls are open another half hour, but I feel pretty confident calling it. To be fair, I've never thought anybody had a chance against Slay. But my experience this evening adds a little more specificity to that thought.

Upon arriving at my polling place about 6:15pm, I was greeted by two folks with the 26th Ward Democratic party. They had two pamphlets, both of which a more cynical person might conclude were almost purposefully designed to undersell Mayor Slay, as if the fact his name is on the ballot is an afterthought. The first one, the 26th Ward sample ballot, includes names of five Democrats. Only one of them, Mayor Slay, is running for a contested position. The other one highlights President Obama, Senator McCaskill, oh yeah, and our Mayor.

Then, I was greeted by a gentleman with the Green Party. Now, as an aside, the Green Party has always fascinated me in St. Louis. Urban politics is not my native tongue, and it's particularly confusing for a 'third' party to actually be the second party in your town. We suburbanites are trained from an early age to accept that there are two major parties and these parties compete with each other for voters. The actual truth, that regionally in many rural and urban areas, there is one major party and several minor parties, is a lot messier and thus not introduced to confuse us white kids from the suburbs. If we're told that the Libertarian Party believes in smaller government and the Green Party believes in universal healthcare, it raises sticky questions about what exactly the Republican and Democratic Parties believe.

Anyway, back to tonight, the Green Party rep had one flyer, and this was specifically for their Mayoral candidate (they are not running a candidate against Darlene Green). It sported the basic message, 'a new day' on one side [ie, a new day from Slay, gotta love those implied marketing slogans], and more detailed policy information on the other.

I was not greeted by anyone from the Coleman or what's-his-name camps (addendum, I of course looked up the Libertarian's name, Robb Cunningham, but I thought it fair to admit that 20 minutes after staring at his name on the ballot, I couldn't recall it).

This is of course informal, unscientific, and only reflective of my precinct after work. It's much like the initial impression you get from a marketing campaign, when you first hear that slogan or see the packaging or something. Gut instincts aren't always right, and they certainly aren't rigorously researched. But if Coleman was counting on enough anybody-but-Slay voters, I think McCowan did a good enough job of earning votes in his own right that even if there's more organized opposition to the Mayor than at first glance, I think Slay walks away with this pretty easily. At about 6:20pm, I cast ballot 165 in my precinct. That's about how many people were waiting in line at 6:00am for the general last fall.

I of course could be wrong. But the Mayor elected my freshman year in college looks to be headed for his third term. Which, interestingly, has actually been very rare. Only three St. Louis Mayors have served three or more terms since about the Civil War. The stuff you learn.

Speaking of stuff you learn, one last tidbit I feel almost embarrassed to have just discovered today. Apparently, McCowan's family van was attacked by an arsonist last week. I don't have any reason to doubt Mr. Rainford's assurances that Mayor Slay had nothing to do with it, but it's very interesting to say the least. I read about it today on CounterPunch when I was googling the race. You'd think that would be big news, particularly since it's not like anyone's scared McCowan could actually win the race, but in fairness, I suppose it is hard to compete with the Women's Final Four, Opening Day, and that airplane-stealing Canadian.

Upon arriving at my polling place about 6:15pm, I was greeted by two folks with the 26th Ward Democratic party. They had two pamphlets, both of which a more cynical person might conclude were almost purposefully designed to undersell Mayor Slay, as if the fact his name is on the ballot is an afterthought. The first one, the 26th Ward sample ballot, includes names of five Democrats. Only one of them, Mayor Slay, is running for a contested position. The other one highlights President Obama, Senator McCaskill, oh yeah, and our Mayor.

Then, I was greeted by a gentleman with the Green Party. Now, as an aside, the Green Party has always fascinated me in St. Louis. Urban politics is not my native tongue, and it's particularly confusing for a 'third' party to actually be the second party in your town. We suburbanites are trained from an early age to accept that there are two major parties and these parties compete with each other for voters. The actual truth, that regionally in many rural and urban areas, there is one major party and several minor parties, is a lot messier and thus not introduced to confuse us white kids from the suburbs. If we're told that the Libertarian Party believes in smaller government and the Green Party believes in universal healthcare, it raises sticky questions about what exactly the Republican and Democratic Parties believe.

Anyway, back to tonight, the Green Party rep had one flyer, and this was specifically for their Mayoral candidate (they are not running a candidate against Darlene Green). It sported the basic message, 'a new day' on one side [ie, a new day from Slay, gotta love those implied marketing slogans], and more detailed policy information on the other.

I was not greeted by anyone from the Coleman or what's-his-name camps (addendum, I of course looked up the Libertarian's name, Robb Cunningham, but I thought it fair to admit that 20 minutes after staring at his name on the ballot, I couldn't recall it).

This is of course informal, unscientific, and only reflective of my precinct after work. It's much like the initial impression you get from a marketing campaign, when you first hear that slogan or see the packaging or something. Gut instincts aren't always right, and they certainly aren't rigorously researched. But if Coleman was counting on enough anybody-but-Slay voters, I think McCowan did a good enough job of earning votes in his own right that even if there's more organized opposition to the Mayor than at first glance, I think Slay walks away with this pretty easily. At about 6:20pm, I cast ballot 165 in my precinct. That's about how many people were waiting in line at 6:00am for the general last fall.

I of course could be wrong. But the Mayor elected my freshman year in college looks to be headed for his third term. Which, interestingly, has actually been very rare. Only three St. Louis Mayors have served three or more terms since about the Civil War. The stuff you learn.

Speaking of stuff you learn, one last tidbit I feel almost embarrassed to have just discovered today. Apparently, McCowan's family van was attacked by an arsonist last week. I don't have any reason to doubt Mr. Rainford's assurances that Mayor Slay had nothing to do with it, but it's very interesting to say the least. I read about it today on CounterPunch when I was googling the race. You'd think that would be big news, particularly since it's not like anyone's scared McCowan could actually win the race, but in fairness, I suppose it is hard to compete with the Women's Final Four, Opening Day, and that airplane-stealing Canadian.

3/31/2009

3/28/2009

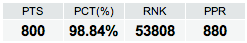

temporary bracket awesomeness

After some rough moments the first weekend, my NCAA bracket is momentarily looking in decent shape. I wanted to pull this screen shot from ESPN tourny challenge before things fall apart heading into the Final Four. Check it out.

And after a perfect 8 for 8, my Facebook bracket has become competitive again. With the right bit of luck, I might knock off Andy and Brian.

I find myself in an interesting fan position, too. I think it looks like there's a really good chance all four #1s make it again to the Final Four. Yet, I find myself rooting for all four of the other teams, Missouri and Michigan State on the left hand side and Oklahoma and Villanova on the right. Isn't March great! Every year, it brings spring, professional unpaid amateur sports, and of course, the last day of the month.

And after a perfect 8 for 8, my Facebook bracket has become competitive again. With the right bit of luck, I might knock off Andy and Brian.

I find myself in an interesting fan position, too. I think it looks like there's a really good chance all four #1s make it again to the Final Four. Yet, I find myself rooting for all four of the other teams, Missouri and Michigan State on the left hand side and Oklahoma and Villanova on the right. Isn't March great! Every year, it brings spring, professional unpaid amateur sports, and of course, the last day of the month.

3/24/2009

the ppip roulette table

(P) Exciting news on the bailout front, we have some more details to chew on regarding the Public-Private Investment Program (ie, the Geithner plan). Essentially, the plan is for government to subsidize the purchase of assets owned by banks.

The plan is neither new nor much of a program. In fact, what was revealed is more like a slow leak of what's been leaking for weeks now about what exactly Geithner, Summers, and other economic voices in the Obama Administration have in mind. What's notable, to be blunt, is the continued lack of transparency about what exactly the ultimate goal is and how exactly the program will get there. It is also hard not to look at the evolution of this idea as being to become purposefully more convoluted and opaque as to make it increasingly difficult for citizens to understand what's going on; the program seems unnecessarily complex precisely for the purpose of masking what it does, and masking what could be done instead.

Before going on, let me add one caveat, and that is that this is easily remedied. Lack of transparency can be very easily addressed by being transparent. This has the additional benefit of being politically sensible as well as letting us analyze the policy outcomes.

But to understand the concept, we don't need to know exactly who will be allowed to buy assets or exactly how the subsidy will work or exactly what the strategic plan is two or three or five steps down the road. And to be honest, that's not where my interest or expertise lies. There are detailed explorations of this that are floating around places like naked capitalism and calculated risk from people who actually are experts about various economic topics.

What I think is helpful is a comparison to an activity that most people can understand. Essentially, the Geithner plan works like a roulette table. There are an equal number of red and black numbers, plus two green ones. [Interesting side note, the American table has two green numbers. The European roulette tables only have one, so the house odds in American casinos are basically twice those of similar European operations. That's a pretty good indicator of how Americans and Europeans differ on a whole range of issues related to risk and corporate control.]

One way to bet is to bet on a color. So say you put $1 down on black. If it comes up black, the house pays you a dollar. If it comes up red, you pay the house a dollar. This is roughly a coin toss, but the 'roughly' is how the casino makes money. Every once in a while, a little over 5% of the time, neither red nor black come up, because two of the numbers are green.

So if you think of this simple bet in expected-value terms, you would expect to earn a dollar about half the time on black, lose a dollar about half the time on red, and lose a dollar every once in awhile on green. In other words, your roulette bet is worth less than a dollar because you expect to lose a dollar more frequently than you expect to gain a dollar. The way that casinos get you to pay a price of one dollar for something that is worth less than one dollar is simple: they appeal to something other than rational, expected-value calculations. They make it fun to gamble. They promise the potential of a big gain. They convince your friends to bring you along on their excursions. Etc.

How does this relate? The core element of plan Geithner is the pricing mechanism. Geithner and Summers are making a very important bet, and like any bet, it's risky. The risk itself is what is costly. The bet is that the various asset-backed securities are priced incorrectly. PPIP is founded on the belief that these assets are priced artificially low; that their 'real' value is higher than current markets are pricing them. The plan is to have government pay private actors to bid on these assets. When the government subsidy is added to the market price, the purchase price will increase.

Here's the problem. On the roulette table, everybody agrees how many black, red, and green numbers exist. Markets, however, do not agree with Treasury and Fed officials about the ratio of black to red to green. Markets are currently pricing assets much lower than banks hold them on their balance sheets. Market prices suggest there are a lot of red numbers and not very many black ones; in other words, the odds of losing money on your black bet aren't close to a coin toss any more. Instead of an expected value of close to one dollar, your expected value has now dropped substantially, perhaps to 40 or even 30 cents on the dollar.

The logical question of a plan designed to leverage private investment is what the Treasury and Fed officials think they know that the very private actors they are relying upon don't know. Hence the need for transparency, for without it, this plan looks like a pretty straightforward transfer of taxpayer money to the banks, just as if the casino decided to remove half the black numbers from the wheel after you had already placed your bet.

The plan is neither new nor much of a program. In fact, what was revealed is more like a slow leak of what's been leaking for weeks now about what exactly Geithner, Summers, and other economic voices in the Obama Administration have in mind. What's notable, to be blunt, is the continued lack of transparency about what exactly the ultimate goal is and how exactly the program will get there. It is also hard not to look at the evolution of this idea as being to become purposefully more convoluted and opaque as to make it increasingly difficult for citizens to understand what's going on; the program seems unnecessarily complex precisely for the purpose of masking what it does, and masking what could be done instead.

Before going on, let me add one caveat, and that is that this is easily remedied. Lack of transparency can be very easily addressed by being transparent. This has the additional benefit of being politically sensible as well as letting us analyze the policy outcomes.

But to understand the concept, we don't need to know exactly who will be allowed to buy assets or exactly how the subsidy will work or exactly what the strategic plan is two or three or five steps down the road. And to be honest, that's not where my interest or expertise lies. There are detailed explorations of this that are floating around places like naked capitalism and calculated risk from people who actually are experts about various economic topics.

What I think is helpful is a comparison to an activity that most people can understand. Essentially, the Geithner plan works like a roulette table. There are an equal number of red and black numbers, plus two green ones. [Interesting side note, the American table has two green numbers. The European roulette tables only have one, so the house odds in American casinos are basically twice those of similar European operations. That's a pretty good indicator of how Americans and Europeans differ on a whole range of issues related to risk and corporate control.]

One way to bet is to bet on a color. So say you put $1 down on black. If it comes up black, the house pays you a dollar. If it comes up red, you pay the house a dollar. This is roughly a coin toss, but the 'roughly' is how the casino makes money. Every once in a while, a little over 5% of the time, neither red nor black come up, because two of the numbers are green.

So if you think of this simple bet in expected-value terms, you would expect to earn a dollar about half the time on black, lose a dollar about half the time on red, and lose a dollar every once in awhile on green. In other words, your roulette bet is worth less than a dollar because you expect to lose a dollar more frequently than you expect to gain a dollar. The way that casinos get you to pay a price of one dollar for something that is worth less than one dollar is simple: they appeal to something other than rational, expected-value calculations. They make it fun to gamble. They promise the potential of a big gain. They convince your friends to bring you along on their excursions. Etc.

How does this relate? The core element of plan Geithner is the pricing mechanism. Geithner and Summers are making a very important bet, and like any bet, it's risky. The risk itself is what is costly. The bet is that the various asset-backed securities are priced incorrectly. PPIP is founded on the belief that these assets are priced artificially low; that their 'real' value is higher than current markets are pricing them. The plan is to have government pay private actors to bid on these assets. When the government subsidy is added to the market price, the purchase price will increase.

Here's the problem. On the roulette table, everybody agrees how many black, red, and green numbers exist. Markets, however, do not agree with Treasury and Fed officials about the ratio of black to red to green. Markets are currently pricing assets much lower than banks hold them on their balance sheets. Market prices suggest there are a lot of red numbers and not very many black ones; in other words, the odds of losing money on your black bet aren't close to a coin toss any more. Instead of an expected value of close to one dollar, your expected value has now dropped substantially, perhaps to 40 or even 30 cents on the dollar.

The logical question of a plan designed to leverage private investment is what the Treasury and Fed officials think they know that the very private actors they are relying upon don't know. Hence the need for transparency, for without it, this plan looks like a pretty straightforward transfer of taxpayer money to the banks, just as if the casino decided to remove half the black numbers from the wheel after you had already placed your bet.

3/21/2009

basketball and bailouts

(P) When the girlfriend's out of town and there's the NCAA tourny on TV, what else is there to think about besides our current economic situation?

The message that I keep coming back to is to not panic. We have a variety of policy options before us, and we don't have to do whatever Fed or Treasury plan happens to be the focus du jour. It's really pretty remarkable the scale of the dollars we've put on the line for these actions, trillions upon trillions of dollars, and yet getting money for much more reasonable activities that have a higher bang for the buck is like pulling teeth. And asking who should pay for this seems to be out of the question entirely. Democrats seem happy to raise the debt ceiling or just flat out print money, while Republicans scream their hypocrisy scream when you point out that spending requires taxation to pay for it. When wealth is so concentrated, the rich are the only people with meaningful amounts of money sitting around to tax.

One of the key methods for persuading people to accept bad options is to convince them the situation is urgent and that better options do not exist, or more subtlely, that there's not time to implement better options. This is a universal principle, whether trying to sell the invasion of a foreign country or something right here at home. And, this is a nonpartisan principle. In our recent times, the GOP has certainly exercised the bulk of this activity, but Democratic officials have not been immune from abandoning calm, rational, thorough analysis to embrace a position that conveniently happens to benefit a major donor.