(P) When the girlfriend's out of town and there's the NCAA tourny on TV, what else is there to think about besides our current economic situation?

The message that I keep coming back to is to not panic. We have a variety of policy options before us, and we don't have to do whatever Fed or Treasury plan happens to be the focus du jour. It's really pretty remarkable the scale of the dollars we've put on the line for these actions, trillions upon trillions of dollars, and yet getting money for much more reasonable activities that have a higher bang for the buck is like pulling teeth. And asking who should pay for this seems to be out of the question entirely. Democrats seem happy to raise the debt ceiling or just flat out print money, while Republicans scream their hypocrisy scream when you point out that spending requires taxation to pay for it. When wealth is so concentrated, the rich are the only people with meaningful amounts of money sitting around to tax.

One of the key methods for persuading people to accept bad options is to convince them the situation is urgent and that better options do not exist, or more subtlely, that there's not time to implement better options. This is a universal principle, whether trying to sell the invasion of a foreign country or something right here at home. And, this is a nonpartisan principle. In our recent times, the GOP has certainly exercised the bulk of this activity, but Democratic officials have not been immune from abandoning calm, rational, thorough analysis to embrace a position that conveniently happens to benefit a major donor.

The dialogue around the AIG bonuses has been particularly interesting this week. The public outcry managed to happen in a way that overwhelmed the corporate messaging system. Talking points didn't get out fast enough, or consistently enough, to control the message. And it really created some fascinating consequences. Are bonuses a distraction, or do they focus attention on the problems? Is executive compensation a rounding error, or a core issue? When public officials talk about transparency and the public knowing where their money is going, what do they mean? Does the public not understand that AIG has been given an amount 1,000 times the recent bonus amount, or does the public get that and the bonuses are precisely the lightning rod for articulating anger at the whole situation? Does the public think AIG is a lone wolf, or part of a larger pattern of corporate abuses, a systemic failure that should be addressed? What was interesting about the pushback against the public anger was that the scale of the dissatisfaction was so widespread that the defenders of AIG couldn't get on the same page about their justifications. That is a tell tale sign that many of the justifications were simply excuses after the fact.

Now, I personally think the outrage is valuable. I think the public has been consistently upset about executive compensation in particular and corporate bailouts more generally. They were pushed on the people, not by the people. But, I do appreciate the truth in some of the positions concerned about the bonus story as a distraction. One of the legitimate observations is that just saying no to something isn't enough. You have to have alternatives. Ranting and raving can be emotionally healing, but you need to do more than just complain, otherwise, you're just being obstructionist. You've got to have something you advocate, something you believe, something you will defend against criticism.

What is not legitimate is claiming we don't have such alternatives. Alternatives are precisely what we have been advocating, whether the time frame is the past month, or past six months, or past year, or past two years, or past 8 years, or even farther back along the ascension of movement conservatism. We do not lack for alternatives. Indeed, people from all sorts of disciplines have all kinds of ideas about how to make a better system.

Last summer, I made the following observation about corporate bailouts

Taxpayers can bail out the losses. This should be an extreme example, but my guess is, this is the 'conventional wisdom' among the people who have influence in DC and what will end up happening.

Indeed, that's pretty much what we've done. We're transferring losses from management and shareholders to taxpayers. That governing philosophy so far has not changed.

But what could we be doing instead? Lots of things. They could have been in ARRA '09. They could have been in EESA '08. (Indeed, bits and pieces of these solutions have made their way into legislation.) They could have been implemented when we first started having problems that reached national attention in 2007. They could have been implemented before our economic problems became a national issue, back when the 'fundamentals' were sound, nevermind tens of millions of Americans looking on from outside the American dream.

One of the most sinister and malicious memes is that our problems are technical in nature, or that the 'experts' don't know what to do. I think one of the most important ways of being vigilant is to educate ourselves of the actual situation. An educated citizenry is an important bulwark of democracy, and it's an important component in combatting the narrative that we shouldn't trust lay opinions, or that Americans are too dumb; we should just leave decision-making in the hands of the deciders. The kernel of truth that makes this lie so powerful is that of course, we can't be certain about outcomes in the future. It wasn't

impossible that Saddam Hussein had nuclear weapons in 2002. Rather, it was highly

improbable. We don't know

for sure that allowing homeowners to stay in their homes as renters would help the situation, but we have good reason to find it

highly probable that would help. We can't be

certain that the government can use its experience nationalizing smaller failed banks to handle the nationalization of larger failed banks, but we can reasonably infer a

high probability of this being a better course of action for society.

Here are some things that various economists, architects, engineers, doctors, lawyers, teachers, custodians, plumbers, trash collectors, writers, and so forth suggest would earn a greater return on our investment than bailing out failed management teams at large corporations. And I think it's very telling that the specifics of these kinds of recommendations are never refuted. People calling for tax cuts or corporate bailouts simply don't respond when it's pointed out to them that things like unemployment insurance and food stamps have a bigger bang-for-the-buck. This doesn't mean we're all going to agree on every one of these points, or that we would all prioritize them similarly. Reality simply is messier than that. The point of evidence-based analysis is to replace ideology with focus on the core question of what works. For if the purpose of action is to solve the problem, then the best course of action is the best means of solving the problem. Opposition to what works is a direct sign of motives other than attempting to solve the problem purported to exist to justify the preferred solution. This recognition alone is not enough to create the political will for evidence-based policy, but I do believe strongly it's a necessary component.

In the immediate term, we should do things like this1. Take over failed firms that are 'too big to fail'. After all, that's why we created the FDIC in the first place, because temporary nationalization is the most efficient means when normal bankruptcy proceedings are not an option. This applies to investment banks and insurance companies just as much as commercial banks.

2. Break up non-failed firms that are 'too big to fail'. It was a Republican president, Teddy Roosevelt, that we usually think of as 'trustbusting'. This is a nonpartisan, no-nonsense, proactive response. If a company is too big to fail, it is too big to exist.

3. Provide direct assistance to stimulate the economy, rather than provide direct assistance to stimulate financial transactions. This means, in particular, universal unemployment insurance, single payer health insurance, expanded TANF and Food Stamps, and so forth. By far, the two biggest causes of mortgage defaults are job losses and medical bills. You don't give banks money so they can afford to write off defaults, or give money to hedge funds to buy the financial instruments tied to the defaults. You give people money so they don't default in the first place. This concept is so basic that it calls into question the motives of people who distract from this core economic reality. Our economic problems, caused by wage stagnation, are causing our financial problems, not the other way around. The short-term solution is to provide a safety net for those out of work.

4. Make the legislative jump from a minimum wage to a living wage. We're already set to increase the minimum wage. Let's make that increase substantially larger. Will a tiny, marginal number of jobs be lost? Probably. That's why we're funding universal unemployment insurance and single payer health insurance. We need to transition away from the concept of a whole class of working poor. In other words, we are experiencing a wage crisis; that's what causes a credit crunch or housing crisis or liquidity trap or other terms floating around in our lexicon these past couple years. While most wage issues are more medium and long-term solutions, the minimum wage is something that could increase quickly to affect workers in the short-term.

5. Use our public policy to save communities, not companies; industries, not particular firms. Tools from changing bankruptcy laws to allow homeowners to stay as renters to using eminent domain to seize properties that banks are not maintaining are quite workable in a short timeframe within our legal framework. We already have bankruptcy judges and city inspectors and police doing evictions and so forth. Let's change some of the parameters of their work.

After these initial coping mechanisms, we can start addressing some of the broader challenges we face1.

Re-connect wages and productivity. This encompasses a variety of reforms like reducing exemptions to FLSA wage and hour guidelines, universal paid time off, meaningful progressive income taxation, increased worker protections (like EFCA for unions and whistleblower protections with substantive rewards for whistleblowers and fines for retaliatory action), and so forth.

2.

Re-regulate industries like financial services. Obama has great rhetoric about 21st century financial regulation. Back when Clinton was building the bridge to the 21st century, the Congressional Republicans and his Administration successfully destroyed the old bridge from the New Deal era. But they purposefully never replaced it. From financial services to media to pharmaceuticals to telecommunications and on, we have a number of industries that need a new set of comprehensive regulations and oversight. These are industries that should be in private hands over the long-term, but they should play by public rules. Either the economic system is governed by democracy, or it owns democracy.

3.

Re-invest in our public commons. Movement conservatism has been very successful at convincing some people that massive public works projects are un-American. And yet, the opposite is true. It's the abandonment of deferred maintenance and new investment that neither conserves our history nor builds our future. This is the bulk of Obama's budget outline, and it appears much of this might come to pass reasonably soon. These are the various infrastructure things like transportation (crumbling roads and bridges, subways, light rail, freight rail, passenger rail, etc), energy (wind, solar, etc), water and sewer systems, education, computers and broadband, parks, etc. There are countless professionals who have written detailed observations about how we can be bigger and bolder in our investments precisely to ensure a safer, healthier, more prosperous future.

4.

Re-write our tax code, in particular, the Internal Revenue Code. Our tax code doesn't make any sense because it's written explicitly for the benefit of special interests. It no longer represents a roughly fair sharing of the national burden of paying for valuable programs. This is unfortunate because it is both inefficient (you really should be able to do your taxes on a postcard) and inequitable (we have basically destroyed progressive taxation with death by a thousand cuts). The vast majority of taxpayers should simply have to report their financial intake for the year, subtract a standard deduction, then calculate the taxes due. That's all filing income taxes should be for about 95% of natural persons filing taxes. Complexity should be the exception, not the rule. The various deductions, at base, are merely methods of shifting the tax burden from its progressive core philosophy to a more regressive reality. Even widely used deductions, like IRAs and home mortgage interest deduction, are still regressive, and they have interesting unintended consequences, too, like subsidizing the buying of bigger houses, which require more land and energy to utilize. With all the talk about McMansions and transportation and energy and suburbia and so forth, the National Association of Realtors works very hard to make sure we don't connect the dots between sprawl and the tax code.

5.

Re-think our social and military policies. I separate this category because I understand things like ending the drug war (or more generally being 'soft' on crime) or substantially reducing farm subsidies or making meaningful cuts to defense budgets are somewhat controversial even outside of the religious and business right. They are some of the most difficult areas to get people to apply evidence-based reasoning. But it's really important to our peace and prosperity to reclaim the limited part of limited government, to end the racial and economic injustices that are inextricably caught up in these kinds of policies. I am a big advocate of reading

the summary at the Drug Policy Alliance if you think the problem isn't that bad, or you think that criminalization is the correct policy response. I understand that it's politically quite difficult to change the madness of militarism, but I don't think that lessons the importance of trying.

We have the same options today we had last fall or last summer or last spring, or in 2007, and despite trillions of dollars more put on the line for corporate bailouts, we're still in the same boat. Indeed, if anything, people think our situation today is worse than any time in the past two years. We are a rich country, and we do not have to panic. We have good options available to us looking forward.

Let's try putting some real resources behind them.

P.S. I forgot to mention.

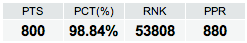

Go Bears! Back to back D-III champions.